SPOILER ALERT!

Personal Insurance Policy: Basic Guidance For Informed Options

Article Developed By-Vilstrup Westermann

When it concerns personal insurance coverage, navigating your choices can really feel overwhelming. You need to evaluate your unique needs and recognize the various types of insurance coverage offered. From health and wellness and car to life and home owners, each serves a details purpose. Understanding how to prioritize your insurance coverage can make a considerable distinction. But what should you take into consideration when contrasting plans? Allow's discover some necessary pointers to aid you make informed choices.

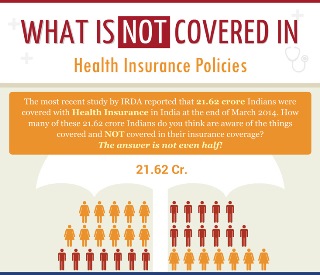

When it pertains to protecting your monetary future, recognizing the various kinds of personal insurance is critical. You'll run into numerous essential alternatives, each offering one-of-a-kind functions.

https://www.abcactionnews.com/news/local-news/here-are-the-six-new-insurance-companies-doing-business-in-florida cover clinical costs, guaranteeing you obtain necessary care without a heavy economic burden. Life insurance policy supplies financial backing for your loved ones in case of your unexpected passing away. Car insurance safeguards you against losses related to car crashes, while homeowners or occupants insurance coverage safeguards your residential property and belongings.

In addition, disability insurance provides earnings substitute if you can't work because of injury or health problem. By familiarizing yourself with these choices, you can make educated choices that straighten with your needs and goals, inevitably reinforcing your financial protection.

Exactly how can you guarantee you have the ideal coverage for your distinct circumstances? Begin by taking a close consider your way of life, assets, and potential dangers.

Take into consideration variables like your age, health, family scenario, and the worth of your possessions. Make a checklist of what's most important to safeguard-- whether it's your home, car, or individual possessions.

Next off, analyze any type of existing insurance coverage you currently have. Exist voids? Do you need more or less protection in specific locations?

Speak to an insurance coverage expert that can assist identify your needs based on your circumstance. Eventually, understanding your individual risks and financial responsibilities will lead you in choosing the appropriate insurance policies to offer assurance.

What should you look for when contrasting insurance plan? Beginning by checking out insurance coverage choices. Make certain the policies cover the particular dangers you're concerned about.

Next off, examine https://drive.google.com/drive/folders/1z0Te8TEnoRsVMk9eXA9ytlEmKvFlzsmJ?usp=drive_open -- compare costs, but do not make rate your just deciding aspect. Consider deductibles; a lower costs often indicates a greater deductible, which could affect your financial resources throughout an insurance claim.

Analyze the insurer's online reputation by reading testimonials and checking their financial stability. Additionally, understand the insurance claims procedure-- guarantee it's straightforward and user-friendly.

Lastly, don't fail to remember to ask about discounts; numerous insurance providers provide discounts for bundling plans or having a good driving document. Taking these steps assists you make an informed choice that ideal suits your demands.

To conclude, navigating individual insurance coverage does not have to be overwhelming. By understanding the various sorts of protection, examining your unique requirements, and comparing policies, you can make enlightened decisions that shield your possessions and health. Don't wait to seek advice from experts for customized advice, and remember to assess your plans frequently. With an aggressive approach, you can ensure you have the ideal coverage while maximizing your advantages and reducing prices. Stay notified and protected!

When it concerns personal insurance coverage, navigating your choices can really feel overwhelming. You need to evaluate your unique needs and recognize the various types of insurance coverage offered. From health and wellness and car to life and home owners, each serves a details purpose. Understanding how to prioritize your insurance coverage can make a considerable distinction. But what should you take into consideration when contrasting plans? Allow's discover some necessary pointers to aid you make informed choices.

Comprehending Various Sorts Of Personal Insurance

When it pertains to protecting your monetary future, recognizing the various kinds of personal insurance is critical. You'll run into numerous essential alternatives, each offering one-of-a-kind functions.

https://www.abcactionnews.com/news/local-news/here-are-the-six-new-insurance-companies-doing-business-in-florida cover clinical costs, guaranteeing you obtain necessary care without a heavy economic burden. Life insurance policy supplies financial backing for your loved ones in case of your unexpected passing away. Car insurance safeguards you against losses related to car crashes, while homeowners or occupants insurance coverage safeguards your residential property and belongings.

In addition, disability insurance provides earnings substitute if you can't work because of injury or health problem. By familiarizing yourself with these choices, you can make educated choices that straighten with your needs and goals, inevitably reinforcing your financial protection.

Assessing Your Insurance Policy Requirements

Exactly how can you guarantee you have the ideal coverage for your distinct circumstances? Begin by taking a close consider your way of life, assets, and potential dangers.

Take into consideration variables like your age, health, family scenario, and the worth of your possessions. Make a checklist of what's most important to safeguard-- whether it's your home, car, or individual possessions.

Next off, analyze any type of existing insurance coverage you currently have. Exist voids? Do you need more or less protection in specific locations?

Speak to an insurance coverage expert that can assist identify your needs based on your circumstance. Eventually, understanding your individual risks and financial responsibilities will lead you in choosing the appropriate insurance policies to offer assurance.

Tips for Comparing Insurance Policies

What should you look for when contrasting insurance plan? Beginning by checking out insurance coverage choices. Make certain the policies cover the particular dangers you're concerned about.

Next off, examine https://drive.google.com/drive/folders/1z0Te8TEnoRsVMk9eXA9ytlEmKvFlzsmJ?usp=drive_open -- compare costs, but do not make rate your just deciding aspect. Consider deductibles; a lower costs often indicates a greater deductible, which could affect your financial resources throughout an insurance claim.

Analyze the insurer's online reputation by reading testimonials and checking their financial stability. Additionally, understand the insurance claims procedure-- guarantee it's straightforward and user-friendly.

Lastly, don't fail to remember to ask about discounts; numerous insurance providers provide discounts for bundling plans or having a good driving document. Taking these steps assists you make an informed choice that ideal suits your demands.

Conclusion

To conclude, navigating individual insurance coverage does not have to be overwhelming. By understanding the various sorts of protection, examining your unique requirements, and comparing policies, you can make enlightened decisions that shield your possessions and health. Don't wait to seek advice from experts for customized advice, and remember to assess your plans frequently. With an aggressive approach, you can ensure you have the ideal coverage while maximizing your advantages and reducing prices. Stay notified and protected!

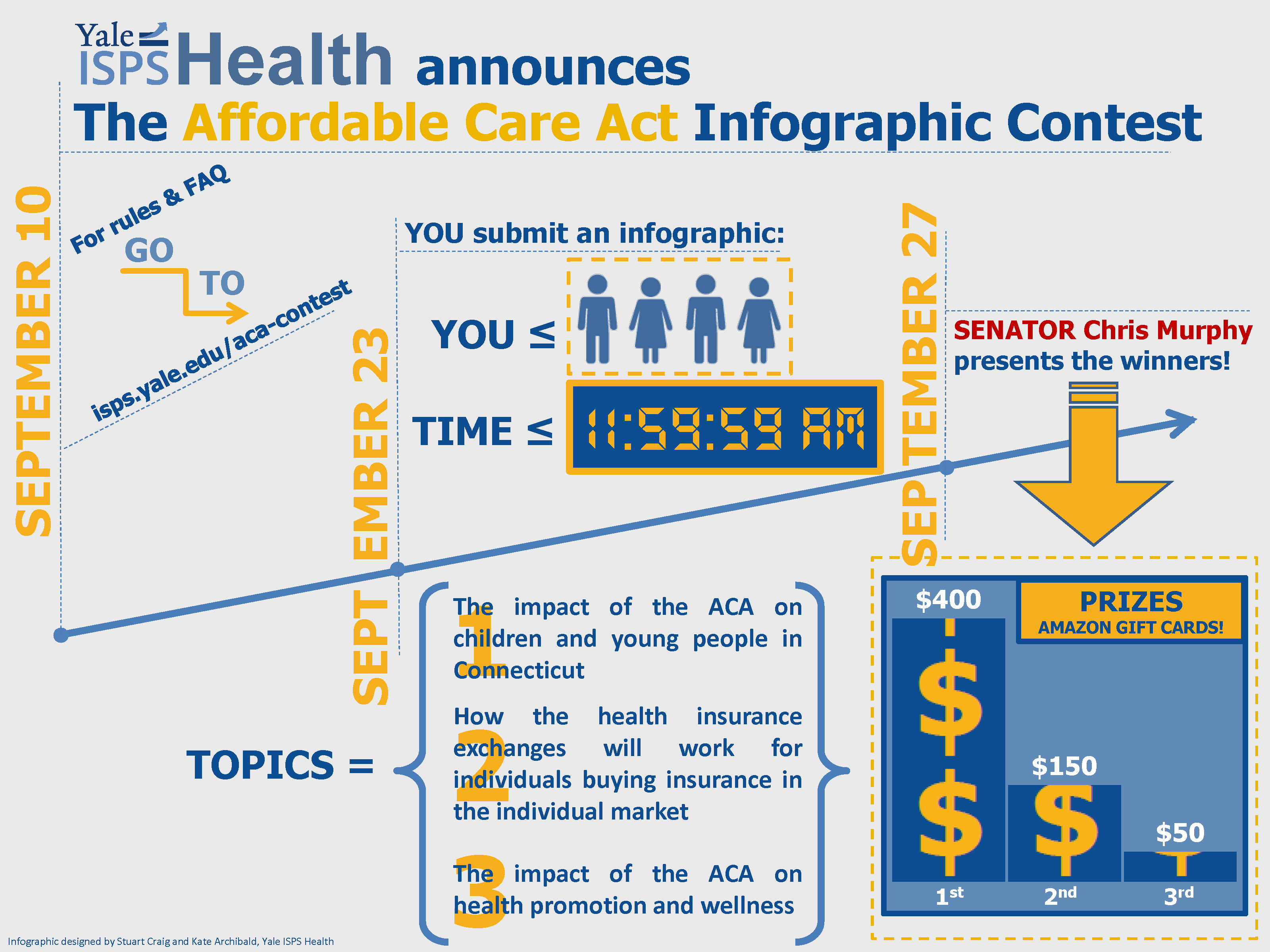

SPOILER ALERT!

Understanding Insurance Policy Alternatives: The Benefits Of Partnering With A Company

Author-Purcell Maddox

Navigating insurance options can really feel difficult, yet it does not have to be. When you companion with an agency, you access to expert advice customized to your certain requirements. Rather than wading through https://www.linkedin.com/company/luxe-insurance-brokers/ , you'll receive individualized support that helps clarify your selections. Yet what exactly can a firm do for you? Allow's discover how this partnership can transform your insurance policy experience.

When it pertains to selecting the appropriate insurance policy protection, taking advantage of the proficiency of insurance experts can make all the distinction.

https://www.michigan.gov/leo/bureaus-agencies/wdca/employees-information recognize the complexities of numerous plans and can help you navigate the typically complicated landscape of insurance coverage choices. They'll analyze your special situation, recognizing your details needs and threats.

With their understanding of the market, they can suggest suitable protection that you mightn't also know exists. And also, they stay upgraded on market trends and changes, ensuring you're always notified.

How can you guarantee your insurance coverage absolutely fits your distinct circumstance? By partnering with an agency, you access to customized remedies customized to your specific needs.

Insurance policy isn't one-size-fits-all; your way of life, properties, and even future goals play a critical function in establishing the ideal coverage for you. A knowledgeable representative will make the effort to recognize your specific scenarios, permitting them to advise policies that supply the very best security.

They can additionally aid recognize gaps in your protection that you might forget. With their expertise, you can feel confident that your insurance coverage aligns with your personal and financial goals, offering you assurance.

Custom-made services mean you're not simply one more insurance holder-- you're a valued customer with special requirements.

Navigating the intricacies of insurance doesn't quit at picking the best protection; it extends to making the claims process as straightforward as possible. When you companion with an agency, you gain access to professional advice throughout this typically complicated procedure.

Your representative can help you comprehend the required actions and documentation called for, guaranteeing you don't miss anything vital. They'll help you in submitting your claim, answering your questions, and advocating on your behalf to accelerate resolution.

This support can dramatically reduce stress and anxiety and confusion, allowing you to focus on what matters most-- coming back on the right track. Ultimately, having an agency at hand simplifies the insurance claims process, enhancing your total insurance policy experience.

Partnering with an insurance policy firm not just simplifies your choices yet likewise guarantees you obtain the protection that fits your one-of-a-kind needs. With specialists leading you with the complexities, you can feel great in your choices. They'll assist you navigate cases and stay updated on fads, giving you satisfaction. By working together, you're not just safeguarding insurance policy; you're safeguarding your future and aligning your protection with your monetary objectives.

Navigating insurance options can really feel difficult, yet it does not have to be. When you companion with an agency, you access to expert advice customized to your certain requirements. Rather than wading through https://www.linkedin.com/company/luxe-insurance-brokers/ , you'll receive individualized support that helps clarify your selections. Yet what exactly can a firm do for you? Allow's discover how this partnership can transform your insurance policy experience.

The Proficiency of Insurance Policy Experts

When it pertains to selecting the appropriate insurance policy protection, taking advantage of the proficiency of insurance experts can make all the distinction.

https://www.michigan.gov/leo/bureaus-agencies/wdca/employees-information recognize the complexities of numerous plans and can help you navigate the typically complicated landscape of insurance coverage choices. They'll analyze your special situation, recognizing your details needs and threats.

With their understanding of the market, they can suggest suitable protection that you mightn't also know exists. And also, they stay upgraded on market trends and changes, ensuring you're always notified.

Custom-made Solutions for Your Demands

How can you guarantee your insurance coverage absolutely fits your distinct circumstance? By partnering with an agency, you access to customized remedies customized to your specific needs.

Insurance policy isn't one-size-fits-all; your way of life, properties, and even future goals play a critical function in establishing the ideal coverage for you. A knowledgeable representative will make the effort to recognize your specific scenarios, permitting them to advise policies that supply the very best security.

They can additionally aid recognize gaps in your protection that you might forget. With their expertise, you can feel confident that your insurance coverage aligns with your personal and financial goals, offering you assurance.

Custom-made services mean you're not simply one more insurance holder-- you're a valued customer with special requirements.

Streamlining the Claims Process

Navigating the intricacies of insurance doesn't quit at picking the best protection; it extends to making the claims process as straightforward as possible. When you companion with an agency, you gain access to professional advice throughout this typically complicated procedure.

Your representative can help you comprehend the required actions and documentation called for, guaranteeing you don't miss anything vital. They'll help you in submitting your claim, answering your questions, and advocating on your behalf to accelerate resolution.

This support can dramatically reduce stress and anxiety and confusion, allowing you to focus on what matters most-- coming back on the right track. Ultimately, having an agency at hand simplifies the insurance claims process, enhancing your total insurance policy experience.

Verdict

Partnering with an insurance policy firm not just simplifies your choices yet likewise guarantees you obtain the protection that fits your one-of-a-kind needs. With specialists leading you with the complexities, you can feel great in your choices. They'll assist you navigate cases and stay updated on fads, giving you satisfaction. By working together, you're not just safeguarding insurance policy; you're safeguarding your future and aligning your protection with your monetary objectives.

SPOILER ALERT!

Personal Insurance Policy: Essential Standards For Smart Decision-Making

Produced By-Chapman Holman

When it concerns individual insurance coverage, browsing your choices can really feel overwhelming. You need to evaluate your one-of-a-kind requirements and comprehend the different sorts of coverage available. From health and wellness and auto to life and house owners, each offers a certain function. Knowing how to prioritize your insurance coverage can make a significant distinction. But what should you think about when comparing plans? Let's explore some necessary ideas to assist you make educated decisions.

When it involves protecting your economic future, recognizing the different types of personal insurance coverage is crucial. You'll run into several key options, each serving one-of-a-kind purposes.

Medical insurance assists cover medical expenditures, ensuring you obtain required treatment without a hefty monetary burden. Life insurance policy provides financial support for your liked ones in case of your untimely passing away. Automobile insurance shields you against losses connected to lorry mishaps, while house owners or renters insurance safeguards your home and belongings.

In addition, disability insurance offers earnings substitute if you can't work because of injury or disease. By familiarizing yourself with these alternatives, you can make informed decisions that straighten with your needs and goals, inevitably strengthening your economic protection.

Exactly how can you ensure you have the ideal coverage for your unique situations? Beginning by taking a close consider your lifestyle, assets, and possible dangers.

Think about elements like your age, wellness, family members situation, and the worth of your ownerships. Make a checklist of what's most important to secure-- whether it's your home, cars and truck, or personal belongings.

Next off, assess any existing coverage you already have. Are there spaces? Do you require basically insurance coverage in details areas?

Speak to an insurance policy specialist who can help recognize your demands based on your situation. Inevitably, recognizing your individual threats and economic obligations will direct you in picking the ideal insurance policies to supply peace of mind.

What should you seek when contrasting insurance plan? Begin by taking a look at protection options. Make certain the plans cover the certain threats you're worried concerning.

Next, check the premiums-- compare costs, yet don't make cost your only deciding element. Look at https://luxeinsurance-brokers.tumblr.com means a higher deductible, which can impact your funds during a claim.

Evaluate https://aws.amazon.com/blogs/machine-learning/automate-the-insurance-claim-lifecycle-using-amazon-bedrock-agents-and-knowledge-bases/ by reading evaluations and examining their economic security. Likewise, recognize the cases procedure-- ensure it's straightforward and straightforward.

Lastly, don't forget to ask about price cuts; lots of insurance providers supply discounts for packing policies or having a great driving document. Taking these steps assists you make an informed option that ideal matches your demands.

Finally, browsing individual insurance policy doesn't have to be frustrating. By comprehending the various sorts of protection, examining your special requirements, and contrasting policies, you can make educated choices that secure your possessions and wellness. Do not hesitate to talk to specialists for tailored recommendations, and bear in mind to examine your plans regularly. With an aggressive method, you can ensure you have the right coverage while maximizing your advantages and decreasing costs. Remain educated and shielded!

When it concerns individual insurance coverage, browsing your choices can really feel overwhelming. You need to evaluate your one-of-a-kind requirements and comprehend the different sorts of coverage available. From health and wellness and auto to life and house owners, each offers a certain function. Knowing how to prioritize your insurance coverage can make a significant distinction. But what should you think about when comparing plans? Let's explore some necessary ideas to assist you make educated decisions.

Recognizing Various Sorts Of Personal Insurance Policy

When it involves protecting your economic future, recognizing the different types of personal insurance coverage is crucial. You'll run into several key options, each serving one-of-a-kind purposes.

Medical insurance assists cover medical expenditures, ensuring you obtain required treatment without a hefty monetary burden. Life insurance policy provides financial support for your liked ones in case of your untimely passing away. Automobile insurance shields you against losses connected to lorry mishaps, while house owners or renters insurance safeguards your home and belongings.

In addition, disability insurance offers earnings substitute if you can't work because of injury or disease. By familiarizing yourself with these alternatives, you can make informed decisions that straighten with your needs and goals, inevitably strengthening your economic protection.

Assessing Your Insurance Requirements

Exactly how can you ensure you have the ideal coverage for your unique situations? Beginning by taking a close consider your lifestyle, assets, and possible dangers.

Think about elements like your age, wellness, family members situation, and the worth of your ownerships. Make a checklist of what's most important to secure-- whether it's your home, cars and truck, or personal belongings.

Next off, assess any existing coverage you already have. Are there spaces? Do you require basically insurance coverage in details areas?

Speak to an insurance policy specialist who can help recognize your demands based on your situation. Inevitably, recognizing your individual threats and economic obligations will direct you in picking the ideal insurance policies to supply peace of mind.

Tips for Comparing Insurance Plan

What should you seek when contrasting insurance plan? Begin by taking a look at protection options. Make certain the plans cover the certain threats you're worried concerning.

Next, check the premiums-- compare costs, yet don't make cost your only deciding element. Look at https://luxeinsurance-brokers.tumblr.com means a higher deductible, which can impact your funds during a claim.

Evaluate https://aws.amazon.com/blogs/machine-learning/automate-the-insurance-claim-lifecycle-using-amazon-bedrock-agents-and-knowledge-bases/ by reading evaluations and examining their economic security. Likewise, recognize the cases procedure-- ensure it's straightforward and straightforward.

Lastly, don't forget to ask about price cuts; lots of insurance providers supply discounts for packing policies or having a great driving document. Taking these steps assists you make an informed option that ideal matches your demands.

Verdict

Finally, browsing individual insurance policy doesn't have to be frustrating. By comprehending the various sorts of protection, examining your special requirements, and contrasting policies, you can make educated choices that secure your possessions and wellness. Do not hesitate to talk to specialists for tailored recommendations, and bear in mind to examine your plans regularly. With an aggressive method, you can ensure you have the right coverage while maximizing your advantages and decreasing costs. Remain educated and shielded!

SPOILER ALERT!

Top 5 Advantages Of Collaborating With A Regional Insurance Agency

Posted By-Godfrey Dickson

When it comes to selecting an insurance coverage company, dealing with a local one can use unique benefits. You'll find individualized service that's customized to your details needs, along with agents who absolutely recognize the distinct risks in your community. This degree of know-how can make a real difference in your insurance coverage choices. However that's just the beginning. Let's explore what else a local agency can provide for you.

When you pick to work with a neighborhood insurance coverage firm, you gain access to customized solution that's tailored specifically to your demands. You're not simply an additional policy number; your agent puts in the time to comprehend your distinct scenario and choices.

This connection permits them to suggest coverage options that fit your way of life and monetary goals. With neighborhood agents, you can expect quick responses and direct interaction, which implies you won't lose time waiting for solutions.

They're purchased your community, so they can give insights that resonate with your atmosphere. By working carefully together, Is RV Insurance Expensive 'll really feel extra certain in your insurance policy options, knowing you have somebody who genuinely cares about securing what matters most to you.

Due to the fact that regional insurance representatives are deeply rooted in your community, they possess an in-depth expertise of the specific dangers you face. They recognize the one-of-a-kind obstacles your location presents, whether it's all-natural calamities, criminal offense rates, or local financial changes.

This experience enables them to analyze your circumstance accurately and advise insurance coverage that truly meets your requirements. Unlike larger, national firms, regional agents can supply understandings right into patterns and occasions that might impact your insurance coverage needs.

They know which plans use the best protection versus local risks, guaranteeing you're not over- or under-insured. With their proficiency, you can navigate your insurance choices with confidence, knowing you're completely covered for the risks details to your community.

Local insurance coverage firms prosper on strong neighborhood partnerships, which substantially improves their capability to offer your demands.

When you deal with a local agency, you're partnering with people that comprehend the distinct challenges and opportunities your neighborhood encounters. They're not just offering plans; they're constructing connections with neighborhood services and family members. This experience permits them to tailor insurance coverage remedies that fit your particular scenario.

In addition, local agents commonly sustain area events and efforts, strengthening their dedication to the location. This involvement suggests they're extra purchased your health.

You can rely on that your local agency will certainly support for you, ensuring you get customized service and support. Fundamentally, strong area connections allow them to be more receptive and efficient in resolving your insurance requires.

One significant benefit of dealing with a local insurance policy firm is the access and comfort they use. You can quickly see their workplace whenever you need aid or have concerns, without the headache of long-distance travel.

Regional agencies frequently have adaptable hours, making it easier to find a time that matches your routine. Plus, you're likely to engage with acquainted faces who recognize your one-of-a-kind requirements and neighborhood context.

Interaction is more simple considering that you can call or stop by for immediate support. In a world where on-line services are prevalent, having a neighborhood company means you can still enjoy an individual touch while accessing crucial insurance solutions rapidly and efficiently.

It's everything about making your life easier.

When you're browsing the cases procedure, having a neighborhood insurance firm on your side can make all the difference.

You'll benefit from customized help tailored to your special circumstance. Your regional agent comprehends the ins and outs of your policy and can direct you through every action, guaranteeing you don't miss any kind of crucial details.

They'll help you collect needed documents, submit cases effectively, and connect with insurance policy insurers in your place. This support lowers your tension and speeds up the process, so you can focus on recovering from your loss.

Plus, if concerns occur, your regional agent is just a telephone call away, prepared to promote for you and ensure you obtain the very best feasible end result.

Dealing with a local insurance firm really makes a difference. You'll value the customized solution that deals with your distinct demands and the agents' deep understanding of neighborhood dangers. Their strong connections to the area guarantee you're well-represented, and their accessibility means you can obtain help whenever you require it. Plus, when it pertains to cases, you'll have dedicated support leading you every step of the way. Choosing https://www.forbes.com/advisor/life-insurance/best-life-insurance-over-50/ is a smart selection for your insurance coverage needs!

When it comes to selecting an insurance coverage company, dealing with a local one can use unique benefits. You'll find individualized service that's customized to your details needs, along with agents who absolutely recognize the distinct risks in your community. This degree of know-how can make a real difference in your insurance coverage choices. However that's just the beginning. Let's explore what else a local agency can provide for you.

Personalized Service Tailored to Your Demands

When you pick to work with a neighborhood insurance coverage firm, you gain access to customized solution that's tailored specifically to your demands. You're not simply an additional policy number; your agent puts in the time to comprehend your distinct scenario and choices.

This connection permits them to suggest coverage options that fit your way of life and monetary goals. With neighborhood agents, you can expect quick responses and direct interaction, which implies you won't lose time waiting for solutions.

They're purchased your community, so they can give insights that resonate with your atmosphere. By working carefully together, Is RV Insurance Expensive 'll really feel extra certain in your insurance policy options, knowing you have somebody who genuinely cares about securing what matters most to you.

Thorough Understanding of Neighborhood Risks

Due to the fact that regional insurance representatives are deeply rooted in your community, they possess an in-depth expertise of the specific dangers you face. They recognize the one-of-a-kind obstacles your location presents, whether it's all-natural calamities, criminal offense rates, or local financial changes.

This experience enables them to analyze your circumstance accurately and advise insurance coverage that truly meets your requirements. Unlike larger, national firms, regional agents can supply understandings right into patterns and occasions that might impact your insurance coverage needs.

They know which plans use the best protection versus local risks, guaranteeing you're not over- or under-insured. With their proficiency, you can navigate your insurance choices with confidence, knowing you're completely covered for the risks details to your community.

Strong Neighborhood Relationships

Local insurance coverage firms prosper on strong neighborhood partnerships, which substantially improves their capability to offer your demands.

When you deal with a local agency, you're partnering with people that comprehend the distinct challenges and opportunities your neighborhood encounters. They're not just offering plans; they're constructing connections with neighborhood services and family members. This experience permits them to tailor insurance coverage remedies that fit your particular scenario.

In addition, local agents commonly sustain area events and efforts, strengthening their dedication to the location. This involvement suggests they're extra purchased your health.

You can rely on that your local agency will certainly support for you, ensuring you get customized service and support. Fundamentally, strong area connections allow them to be more receptive and efficient in resolving your insurance requires.

Availability and Convenience

One significant benefit of dealing with a local insurance policy firm is the access and comfort they use. You can quickly see their workplace whenever you need aid or have concerns, without the headache of long-distance travel.

Regional agencies frequently have adaptable hours, making it easier to find a time that matches your routine. Plus, you're likely to engage with acquainted faces who recognize your one-of-a-kind requirements and neighborhood context.

Interaction is more simple considering that you can call or stop by for immediate support. In a world where on-line services are prevalent, having a neighborhood company means you can still enjoy an individual touch while accessing crucial insurance solutions rapidly and efficiently.

It's everything about making your life easier.

Assistance During Cases Refine

When you're browsing the cases procedure, having a neighborhood insurance firm on your side can make all the difference.

You'll benefit from customized help tailored to your special circumstance. Your regional agent comprehends the ins and outs of your policy and can direct you through every action, guaranteeing you don't miss any kind of crucial details.

They'll help you collect needed documents, submit cases effectively, and connect with insurance policy insurers in your place. This support lowers your tension and speeds up the process, so you can focus on recovering from your loss.

Plus, if concerns occur, your regional agent is just a telephone call away, prepared to promote for you and ensure you obtain the very best feasible end result.

Conclusion

Dealing with a local insurance firm really makes a difference. You'll value the customized solution that deals with your distinct demands and the agents' deep understanding of neighborhood dangers. Their strong connections to the area guarantee you're well-represented, and their accessibility means you can obtain help whenever you require it. Plus, when it pertains to cases, you'll have dedicated support leading you every step of the way. Choosing https://www.forbes.com/advisor/life-insurance/best-life-insurance-over-50/ is a smart selection for your insurance coverage needs!

SPOILER ALERT!

Recognizing The Ideal Insurance Policy Broker: Trick Details To Examine For Comprehensive Coverage

Web Content By-Zachariassen Maynard

When it pertains to protecting the best insurance protection, choosing the best broker is vital. You need somebody who understands your special demands and can browse the complexities of various plans. By concentrating on crucial variables like credentials, market experience, and interaction style, you can make a much more informed selection. However just how do you make sure that your broker will adjust to your transforming requirements over time? Let's discover what to try to find in a broker.

Exactly how well do you comprehend your insurance coverage needs? Before picking an insurance broker, it's vital to identify what insurance coverage you call for.

Start by assessing your properties, way of living, and prospective threats. Take into consideration whether you need homeowners, vehicle, or health insurance, and think of the details protection restrictions that fit your circumstance.

It's additionally smart to review your monetary objectives and any existing policies you might have. Recognizing your requirements assists in connecting successfully with your broker, ensuring they customize their referrals to your certain scenarios.

Do not think twice to ask inquiries or seek information on plan details. By realizing your insurance needs, you'll encourage yourself to make enlightened decisions and find the best broker to support you.

Once you have actually pinpointed your insurance policy requires, the next action is examining potential brokers to guarantee they've the right credentials and experience.

Beginning by checking their credentials, such as licenses and accreditations, which indicate their experience in the field. Seek brokers with a strong track record in your details market or type of coverage; this experience can make a significant difference in comprehending your one-of-a-kind risks.

Do not be reluctant to ask about their years in business and the range of customers they've served. Additionally, consider their specialist affiliations, which can show commitment to recurring education and market criteria.

Evaluating these elements will aid you discover a broker that's well-equipped to meet your insurance policy requires successfully.

When reviewing an insurance policy broker, have you considered just how well they interact with you? Off Road Vehicle is critical for an effective collaboration. You ought to really feel comfy asking inquiries and expect prompt, clear reactions.

Pay attention to their accessibility-- do they offer assistance throughout company hours, or are they easily accessible after hours?

In addition, examine their willingness to explain plan details in such a way you can conveniently comprehend. A broker who prioritizes your needs will give recurring assistance, not just during the first sale.

Motorcycle Insurance Rates for evaluations or endorsements that highlight their responsiveness and client service. By selecting a broker that values interaction, you'll feel extra certain in your insurance coverage choices and overall insurance coverage experience.

Finally, picking the ideal insurance broker is crucial for safeguarding the protection you need. By recognizing your own insurance coverage needs and examining a broker's qualifications, experience, and communication abilities, you can make an informed decision. Do not take too lightly the value of developing a solid relationship with your broker, as it can result in ongoing assistance and customized services. Inevitably, this partnership will aid safeguard your possessions and adjust to your altering requirements gradually.

When it pertains to protecting the best insurance protection, choosing the best broker is vital. You need somebody who understands your special demands and can browse the complexities of various plans. By concentrating on crucial variables like credentials, market experience, and interaction style, you can make a much more informed selection. However just how do you make sure that your broker will adjust to your transforming requirements over time? Let's discover what to try to find in a broker.

Comprehending Your Insurance Needs

Exactly how well do you comprehend your insurance coverage needs? Before picking an insurance broker, it's vital to identify what insurance coverage you call for.

Start by assessing your properties, way of living, and prospective threats. Take into consideration whether you need homeowners, vehicle, or health insurance, and think of the details protection restrictions that fit your circumstance.

It's additionally smart to review your monetary objectives and any existing policies you might have. Recognizing your requirements assists in connecting successfully with your broker, ensuring they customize their referrals to your certain scenarios.

Do not think twice to ask inquiries or seek information on plan details. By realizing your insurance needs, you'll encourage yourself to make enlightened decisions and find the best broker to support you.

Assessing Broker Accreditations and Experience

Once you have actually pinpointed your insurance policy requires, the next action is examining potential brokers to guarantee they've the right credentials and experience.

Beginning by checking their credentials, such as licenses and accreditations, which indicate their experience in the field. Seek brokers with a strong track record in your details market or type of coverage; this experience can make a significant difference in comprehending your one-of-a-kind risks.

Do not be reluctant to ask about their years in business and the range of customers they've served. Additionally, consider their specialist affiliations, which can show commitment to recurring education and market criteria.

Evaluating these elements will aid you discover a broker that's well-equipped to meet your insurance policy requires successfully.

Assessing Interaction and Assistance Solutions

When reviewing an insurance policy broker, have you considered just how well they interact with you? Off Road Vehicle is critical for an effective collaboration. You ought to really feel comfy asking inquiries and expect prompt, clear reactions.

Pay attention to their accessibility-- do they offer assistance throughout company hours, or are they easily accessible after hours?

In addition, examine their willingness to explain plan details in such a way you can conveniently comprehend. A broker who prioritizes your needs will give recurring assistance, not just during the first sale.

Motorcycle Insurance Rates for evaluations or endorsements that highlight their responsiveness and client service. By selecting a broker that values interaction, you'll feel extra certain in your insurance coverage choices and overall insurance coverage experience.

Final thought

Finally, picking the ideal insurance broker is crucial for safeguarding the protection you need. By recognizing your own insurance coverage needs and examining a broker's qualifications, experience, and communication abilities, you can make an informed decision. Do not take too lightly the value of developing a solid relationship with your broker, as it can result in ongoing assistance and customized services. Inevitably, this partnership will aid safeguard your possessions and adjust to your altering requirements gradually.

SPOILER ALERT!

Personal Insurance Policy: Key Suggestions For Thoughtful Choices

Web Content Writer-Dehn Holman

When it concerns personal insurance coverage, navigating your choices can really feel frustrating. You need to examine your special demands and understand the different kinds of insurance coverage readily available. From health and wellness and car to life and property owners, each offers a details purpose. Knowing how to prioritize your protection can make a substantial difference. However what should you think about when contrasting policies? Allow's explore some important pointers to assist you make educated decisions.

When it comes to safeguarding your economic future, recognizing the various types of individual insurance coverage is critical. You'll encounter numerous crucial options, each serving one-of-a-kind objectives.

Health insurance aids cover medical expenditures, guaranteeing you obtain needed care without a hefty financial burden. Life insurance policy provides financial support for your liked ones in case of your unfortunate passing. Auto insurance shields you versus losses connected to lorry crashes, while property owners or tenants insurance policy safeguards your building and belongings.

Additionally, disability insurance provides earnings replacement if you can't function as a result of injury or ailment. By familiarizing on your own with these options, you can make educated choices that straighten with your needs and objectives, ultimately enhancing your monetary safety and security.

Exactly how can you guarantee you have the right coverage for your one-of-a-kind conditions? Beginning by taking a close check out your way of living, assets, and possible dangers.

Take into consideration elements like your age, health, family members circumstance, and the worth of your properties. Make https://www.kiplinger.com/personal-finance/home-insurance/how-much-does-flood-insurance-cost of what's essential to protect-- whether it's your home, automobile, or personal possessions.

Next off, examine any existing protection you currently have. Exist voids? Do you need basically protection in details areas?

Speak to an insurance coverage specialist who can assist identify your demands based on your circumstance. Inevitably, recognizing Is Flood Insurance Expensive and financial responsibilities will lead you in choosing the right insurance coverage to offer satisfaction.

What should you look for when comparing insurance plan? Start by checking out insurance coverage alternatives. Ensure the plans cover the specific threats you're concerned concerning.

Next off, inspect the costs-- contrast prices, but do not make rate your only deciding factor. Consider deductibles; a reduced premium typically suggests a higher deductible, which can impact your funds during a claim.

Evaluate the insurer's credibility by reading evaluations and examining their monetary stability. Likewise, understand the insurance claims process-- guarantee it's straightforward and straightforward.

Lastly, don't forget to inquire about discounts; numerous insurance companies provide discount rates for packing plans or having an excellent driving record. Taking these steps aids you make an informed option that finest fits your requirements.

To conclude, navigating personal insurance policy doesn't have to be overwhelming. By comprehending the various kinds of coverage, assessing your distinct needs, and contrasting policies, you can make informed decisions that secure your assets and wellness. Do not wait to speak with specialists for customized guidance, and remember to review your plans frequently. With a positive technique, you can guarantee you have the best protection while optimizing your advantages and minimizing costs. Remain educated and protected!

When it concerns personal insurance coverage, navigating your choices can really feel frustrating. You need to examine your special demands and understand the different kinds of insurance coverage readily available. From health and wellness and car to life and property owners, each offers a details purpose. Knowing how to prioritize your protection can make a substantial difference. However what should you think about when contrasting policies? Allow's explore some important pointers to assist you make educated decisions.

Comprehending Various Kinds Of Personal Insurance Coverage

When it comes to safeguarding your economic future, recognizing the various types of individual insurance coverage is critical. You'll encounter numerous crucial options, each serving one-of-a-kind objectives.

Health insurance aids cover medical expenditures, guaranteeing you obtain needed care without a hefty financial burden. Life insurance policy provides financial support for your liked ones in case of your unfortunate passing. Auto insurance shields you versus losses connected to lorry crashes, while property owners or tenants insurance policy safeguards your building and belongings.

Additionally, disability insurance provides earnings replacement if you can't function as a result of injury or ailment. By familiarizing on your own with these options, you can make educated choices that straighten with your needs and objectives, ultimately enhancing your monetary safety and security.

Assessing Your Insurance Demands

Exactly how can you guarantee you have the right coverage for your one-of-a-kind conditions? Beginning by taking a close check out your way of living, assets, and possible dangers.

Take into consideration elements like your age, health, family members circumstance, and the worth of your properties. Make https://www.kiplinger.com/personal-finance/home-insurance/how-much-does-flood-insurance-cost of what's essential to protect-- whether it's your home, automobile, or personal possessions.

Next off, examine any existing protection you currently have. Exist voids? Do you need basically protection in details areas?

Speak to an insurance coverage specialist who can assist identify your demands based on your circumstance. Inevitably, recognizing Is Flood Insurance Expensive and financial responsibilities will lead you in choosing the right insurance coverage to offer satisfaction.

Tips for Comparing Insurance Plan

What should you look for when comparing insurance plan? Start by checking out insurance coverage alternatives. Ensure the plans cover the specific threats you're concerned concerning.

Next off, inspect the costs-- contrast prices, but do not make rate your only deciding factor. Consider deductibles; a reduced premium typically suggests a higher deductible, which can impact your funds during a claim.

Evaluate the insurer's credibility by reading evaluations and examining their monetary stability. Likewise, understand the insurance claims process-- guarantee it's straightforward and straightforward.

Lastly, don't forget to inquire about discounts; numerous insurance companies provide discount rates for packing plans or having an excellent driving record. Taking these steps aids you make an informed option that finest fits your requirements.

Conclusion

To conclude, navigating personal insurance policy doesn't have to be overwhelming. By comprehending the various kinds of coverage, assessing your distinct needs, and contrasting policies, you can make informed decisions that secure your assets and wellness. Do not wait to speak with specialists for customized guidance, and remember to review your plans frequently. With a positive technique, you can guarantee you have the best protection while optimizing your advantages and minimizing costs. Remain educated and protected!

SPOILER ALERT!

Impressive Insurance Coverage Agents Have Vital Skills Like Interaction And Settlement - Find Out Just How These Capacities Navigate Their Course To Success

Short Article Created By-Hassing Nedergaard

When browsing the large landscape of the insurance industry, picture on your own as a competent navigator with a compass in hand, charting a course towards success. As an insurance coverage agent, necessary abilities are the guiding celebrities that will certainly lead you through unstable waters.

From the capability to connect successfully to mastering the art of settlement, the course to ending up being an effective insurance representative is led with important proficiencies. However what are these abilities, and exactly how do they form the trip in advance?

When engaging with customers and coworkers, you need to effectively interact and show strong social abilities. Clear interaction is important in the insurance policy industry to ensure customers recognize policies and make educated choices.

Energetic listening is vital to understanding customer demands and providing tailored solutions. Building connection through empathy and understanding develops trust fund, cultivating long-term partnerships. Problem resolution abilities are vital for managing tight spots professionally and keeping client satisfaction.

Teaming up with associates needs reliable interaction to improve procedures and achieve usual objectives. Developing solid interpersonal skills not just improves customer interactions but also fosters a favorable workplace. Constantly sharpening these skills will establish you apart as an effective insurance agent in a competitive sector.

Establish your analytic and analytical capabilities to excel as an insurance policy agent in a dynamic and hectic sector. As an insurance representative, you'll encounter different difficulties that need fast reasoning and audio decision-making.

Below are 4 essential methods to boost your analytical and logical abilities:

1. ** Critical Believing **: Examine circumstances fairly and make notified choices.

2. ** Interest to Information **: Notice small inconsistencies that could affect insurance plan or cases.

3. ** Flexibility **: Be adaptable in your strategy to handling different insurance policy circumstances.

4. ** Data Analysis **: Utilize data to determine patterns, examine dangers, and tailor insurance coverage solutions to clients' needs.

To excel as an insurance coverage representative, understanding sales and settlement effectiveness is necessary for properly securing clients and safeguarding desirable insurance coverage offers. Being experienced at sales permits you to interact the value of insurance policy items persuasively, resolving customers' requirements with tailored options.

Strong settlement abilities enable you to browse pricing discussions, terms, and problems to reach agreements that profit both events. By recognizing just click the following article and arguments, you can tailor your approach to resolve their certain needs, raising the likelihood of shutting bargains successfully.

Developing a tactical frame of mind in sales and settlement encourages you to build trust fund, overcome arguments, and ultimately drive organization development by increasing your client base and promoting long-lasting relationships.

Temporary RV Insurance

In conclusion, as an insurance representative, grasping communication, analytical, and sales skills is crucial to your success.

Remember, 'method makes ideal' - continue developing these crucial skills to master the competitive insurance sector.

https://lemuel-renata.technetbloggers.de/journey-into-the-globe-of-employing-an-insurance-coverage-representative-with-caution-as-avoiding-usual-mistakes-can-influence-your-insurance-policy-needs-significantly inspired, stay focused, and never quit finding out.

Good luck on your trip to coming to be a successful insurance coverage agent!

When browsing the large landscape of the insurance industry, picture on your own as a competent navigator with a compass in hand, charting a course towards success. As an insurance coverage agent, necessary abilities are the guiding celebrities that will certainly lead you through unstable waters.

From the capability to connect successfully to mastering the art of settlement, the course to ending up being an effective insurance representative is led with important proficiencies. However what are these abilities, and exactly how do they form the trip in advance?

Communication and Interpersonal Skills

When engaging with customers and coworkers, you need to effectively interact and show strong social abilities. Clear interaction is important in the insurance policy industry to ensure customers recognize policies and make educated choices.

Energetic listening is vital to understanding customer demands and providing tailored solutions. Building connection through empathy and understanding develops trust fund, cultivating long-term partnerships. Problem resolution abilities are vital for managing tight spots professionally and keeping client satisfaction.

Teaming up with associates needs reliable interaction to improve procedures and achieve usual objectives. Developing solid interpersonal skills not just improves customer interactions but also fosters a favorable workplace. Constantly sharpening these skills will establish you apart as an effective insurance agent in a competitive sector.

Problem-Solving and Analytical Talents

Establish your analytic and analytical capabilities to excel as an insurance policy agent in a dynamic and hectic sector. As an insurance representative, you'll encounter different difficulties that need fast reasoning and audio decision-making.

Below are 4 essential methods to boost your analytical and logical abilities:

1. ** Critical Believing **: Examine circumstances fairly and make notified choices.

2. ** Interest to Information **: Notice small inconsistencies that could affect insurance plan or cases.

3. ** Flexibility **: Be adaptable in your strategy to handling different insurance policy circumstances.

4. ** Data Analysis **: Utilize data to determine patterns, examine dangers, and tailor insurance coverage solutions to clients' needs.

Sales and Settlement Efficiency

To excel as an insurance coverage representative, understanding sales and settlement effectiveness is necessary for properly securing clients and safeguarding desirable insurance coverage offers. Being experienced at sales permits you to interact the value of insurance policy items persuasively, resolving customers' requirements with tailored options.

Strong settlement abilities enable you to browse pricing discussions, terms, and problems to reach agreements that profit both events. By recognizing just click the following article and arguments, you can tailor your approach to resolve their certain needs, raising the likelihood of shutting bargains successfully.

Developing a tactical frame of mind in sales and settlement encourages you to build trust fund, overcome arguments, and ultimately drive organization development by increasing your client base and promoting long-lasting relationships.

Temporary RV Insurance

In conclusion, as an insurance representative, grasping communication, analytical, and sales skills is crucial to your success.

Remember, 'method makes ideal' - continue developing these crucial skills to master the competitive insurance sector.

https://lemuel-renata.technetbloggers.de/journey-into-the-globe-of-employing-an-insurance-coverage-representative-with-caution-as-avoiding-usual-mistakes-can-influence-your-insurance-policy-needs-significantly inspired, stay focused, and never quit finding out.

Good luck on your trip to coming to be a successful insurance coverage agent!

SPOILER ALERT!

Wondering How To Select The Ideal Insurance Coverage Broker To Safeguard Your Monetary Future?

Web Content By-Medina Vazquez

When it comes to insurance, did you understand that 48% of small businesses in the United States have never had insurance policy?

Finding the right insurance coverage broker for your demands can be an essential decision that affects your economic safety and security and comfort.

With a lot of choices offered, browsing the globe of insurance coverage can be overwhelming.

Recognizing just how to choose https://thi04carli.werite.net/what-crucial-inquiries-ought-to-be-guided-to-your-insurance-representative that understands your unique needs and provides the best protection can make all the distinction.

Prior to selecting an insurance broker, it's important to extensively analyze your particular needs and economic situation. Take the time to assess what sort of protection you need and just how much you can afford to pay in costs.

Study various brokers to identify their knowledge in the areas that matter most to you, whether it's health, vehicle, home, or life insurance policy. Consider their credibility, client testimonials, and any type of problems lodged against them.

It's also vital to ask about the variety of policies they provide and compare costs to guarantee you're obtaining the most effective worth for your money. By being Flood Insurance in your analysis, you can make an informed choice that satisfies your insurance policy requires properly.

To effectively examine an insurance broker, take into consideration initiating your assessment by examining their track record, proficiency, and consumer responses. Begin by evaluating their previous efficiency, market expertise, and client contentment levels.

Here are some steps to help you completely examine an insurance coverage broker:

- ** Check Track Record: ** Look into their background of successful insurance policy placements.

- ** Analyze Competence: ** Examine their expertise in the sort of insurance policy you require.

- ** Review Customer Feedback: ** Read reviews and testimonials from previous clients.

- ** Confirm Qualifications: ** Guarantee they're licensed and affiliated with credible insurance service providers.

- ** Meeting Directly: ** Schedule a meeting to discuss your needs and determine their professionalism and trust.

Make sure that your decision is informed by extensively looking into several insurance brokers in your area. Start by checking their qualifications and licenses to operate. Confirm their experience and competence in handling insurance policy needs comparable to your own. Check out client testimonials and testimonies to evaluate customer contentment levels. Seek recommendations from good friends, household, or colleagues that've had favorable experiences with insurance coverage brokers.

Contrast the solutions offered, including the range of insurance policy items they provide and their pricing structures. Try to find brokers who interact clearly, pay attention diligently to your needs, and are responsive to your questions. Trust fund your instincts and pick a broker that makes you feel comfortable and certain in their capacities to help you successfully.

Conclusion

So, currently you have all the devices to find the excellent insurance policy broker for your needs. Keep in mind to trust your digestive tract, do your research, and ask the best inquiries.

Do not go for the first option you come across; see to it to discover all your choices. Ultimately, it's much better to be secure than sorry.

Happy hunting!

When it comes to insurance, did you understand that 48% of small businesses in the United States have never had insurance policy?

Finding the right insurance coverage broker for your demands can be an essential decision that affects your economic safety and security and comfort.

With a lot of choices offered, browsing the globe of insurance coverage can be overwhelming.

Recognizing just how to choose https://thi04carli.werite.net/what-crucial-inquiries-ought-to-be-guided-to-your-insurance-representative that understands your unique needs and provides the best protection can make all the distinction.

Variables to Think About Prior To Picking

Prior to selecting an insurance broker, it's important to extensively analyze your particular needs and economic situation. Take the time to assess what sort of protection you need and just how much you can afford to pay in costs.

Study various brokers to identify their knowledge in the areas that matter most to you, whether it's health, vehicle, home, or life insurance policy. Consider their credibility, client testimonials, and any type of problems lodged against them.

It's also vital to ask about the variety of policies they provide and compare costs to guarantee you're obtaining the most effective worth for your money. By being Flood Insurance in your analysis, you can make an informed choice that satisfies your insurance policy requires properly.

Steps to Examine Insurance Coverage Broker

To effectively examine an insurance broker, take into consideration initiating your assessment by examining their track record, proficiency, and consumer responses. Begin by evaluating their previous efficiency, market expertise, and client contentment levels.

Here are some steps to help you completely examine an insurance coverage broker:

- ** Check Track Record: ** Look into their background of successful insurance policy placements.

- ** Analyze Competence: ** Examine their expertise in the sort of insurance policy you require.

- ** Review Customer Feedback: ** Read reviews and testimonials from previous clients.

- ** Confirm Qualifications: ** Guarantee they're licensed and affiliated with credible insurance service providers.

- ** Meeting Directly: ** Schedule a meeting to discuss your needs and determine their professionalism and trust.

Tips for Making the Right Choice

Make sure that your decision is informed by extensively looking into several insurance brokers in your area. Start by checking their qualifications and licenses to operate. Confirm their experience and competence in handling insurance policy needs comparable to your own. Check out client testimonials and testimonies to evaluate customer contentment levels. Seek recommendations from good friends, household, or colleagues that've had favorable experiences with insurance coverage brokers.

Contrast the solutions offered, including the range of insurance policy items they provide and their pricing structures. Try to find brokers who interact clearly, pay attention diligently to your needs, and are responsive to your questions. Trust fund your instincts and pick a broker that makes you feel comfortable and certain in their capacities to help you successfully.

Conclusion

So, currently you have all the devices to find the excellent insurance policy broker for your needs. Keep in mind to trust your digestive tract, do your research, and ask the best inquiries.

Do not go for the first option you come across; see to it to discover all your choices. Ultimately, it's much better to be secure than sorry.

Happy hunting!

SPOILER ALERT!

Required Capacities For Insurance Coverage Representatives To Accomplish Success

Write-Up By-Bille Guerra

When navigating the vast landscape of the insurance policy market, visualize yourself as a skilled navigator with a compass in hand, charting a course in the direction of success. As an insurance agent, important skills are the assisting stars that will certainly lead you through unstable waters.

From the capacity to communicate efficiently to mastering the art of arrangement, the course to ending up being an effective insurance policy representative is paved with critical competencies. Yet what are these abilities, and how do they shape the trip ahead?

When engaging with clients and colleagues, you have to successfully communicate and show strong social skills. Clear interaction is important in the insurance sector to make certain clients recognize plans and make educated choices.

Active listening is vital to understanding client demands and providing tailored services. Building rapport through empathy and understanding establishes trust fund, cultivating lasting relationships. Problem resolution abilities are crucial for taking care of tight spots expertly and maintaining customer satisfaction.

https://canvas.instructure.com/eportfolios/3375668/home/look-into-a-ball-of-customized-assistance-and-specialized-services-with-a-neighborhood-insurance-coverage-firm-experience-the-unique-advantages-that-lie-ahead with colleagues needs effective communication to streamline processes and attain usual objectives. Creating strong social abilities not just improves customer interactions yet likewise promotes a favorable workplace. Continually refining https://www.wktv.com/news/local-business/new-insurance-agent-in-north-utica-office/article_6b7a7386-19df-11ee-85b4-83d03ca5a69b.html will certainly establish you apart as a successful insurance coverage representative in an affordable sector.

Develop your analytic and logical capabilities to stand out as an insurance policy agent in a dynamic and fast-paced market. As an insurance coverage agent, you'll come across numerous obstacles that require fast reasoning and sound decision-making.

Here are 4 vital ways to boost your problem-solving and analytical abilities:

1. ** Vital Thinking **: Examine circumstances objectively and make educated decisions.

2. ** Attention to Information **: Notification tiny discrepancies that can impact insurance policies or claims.

3. ** Flexibility **: Be adaptable in your approach to taking care of various insurance policy circumstances.

4. ** Information Evaluation **: Make use of data to determine fads, assess dangers, and tailor insurance coverage solutions to customers' demands.

To succeed as an insurance policy agent, grasping sales and negotiation proficiency is essential for properly safeguarding clients and protecting desirable insurance coverage bargains. Being adept at sales allows you to interact the worth of insurance policy items persuasively, dealing with customers' demands with tailored remedies.

Solid negotiation abilities enable you to browse pricing conversations, terms, and conditions to reach agreements that profit both celebrations. By comprehending clients' worries and arguments, you can customize your approach to address their details needs, increasing the chance of closing deals effectively.

Creating a tactical attitude in sales and arrangement empowers you to build count on, get rid of arguments, and ultimately drive company growth by increasing your customer base and fostering lasting connections.

Verdict

In conclusion, as an insurance coverage representative, grasping interaction, analytic, and sales skills is essential to your success.

Bear in mind, 'technique makes best' - continue sharpening these vital abilities to master the affordable insurance policy market.

Stay encouraged, stay concentrated, and never stop learning.

All the best on your trip to becoming a successful insurance policy representative!

When navigating the vast landscape of the insurance policy market, visualize yourself as a skilled navigator with a compass in hand, charting a course in the direction of success. As an insurance agent, important skills are the assisting stars that will certainly lead you through unstable waters.

From the capacity to communicate efficiently to mastering the art of arrangement, the course to ending up being an effective insurance policy representative is paved with critical competencies. Yet what are these abilities, and how do they shape the trip ahead?

Interaction and Interpersonal Skills

When engaging with clients and colleagues, you have to successfully communicate and show strong social skills. Clear interaction is important in the insurance sector to make certain clients recognize plans and make educated choices.

Active listening is vital to understanding client demands and providing tailored services. Building rapport through empathy and understanding establishes trust fund, cultivating lasting relationships. Problem resolution abilities are crucial for taking care of tight spots expertly and maintaining customer satisfaction.

https://canvas.instructure.com/eportfolios/3375668/home/look-into-a-ball-of-customized-assistance-and-specialized-services-with-a-neighborhood-insurance-coverage-firm-experience-the-unique-advantages-that-lie-ahead with colleagues needs effective communication to streamline processes and attain usual objectives. Creating strong social abilities not just improves customer interactions yet likewise promotes a favorable workplace. Continually refining https://www.wktv.com/news/local-business/new-insurance-agent-in-north-utica-office/article_6b7a7386-19df-11ee-85b4-83d03ca5a69b.html will certainly establish you apart as a successful insurance coverage representative in an affordable sector.

Problem-Solving and Analytical Talents

Develop your analytic and logical capabilities to stand out as an insurance policy agent in a dynamic and fast-paced market. As an insurance coverage agent, you'll come across numerous obstacles that require fast reasoning and sound decision-making.

Here are 4 vital ways to boost your problem-solving and analytical abilities:

1. ** Vital Thinking **: Examine circumstances objectively and make educated decisions.

2. ** Attention to Information **: Notification tiny discrepancies that can impact insurance policies or claims.

3. ** Flexibility **: Be adaptable in your approach to taking care of various insurance policy circumstances.

4. ** Information Evaluation **: Make use of data to determine fads, assess dangers, and tailor insurance coverage solutions to customers' demands.

Sales and Arrangement Effectiveness

To succeed as an insurance policy agent, grasping sales and negotiation proficiency is essential for properly safeguarding clients and protecting desirable insurance coverage bargains. Being adept at sales allows you to interact the worth of insurance policy items persuasively, dealing with customers' demands with tailored remedies.

Solid negotiation abilities enable you to browse pricing conversations, terms, and conditions to reach agreements that profit both celebrations. By comprehending clients' worries and arguments, you can customize your approach to address their details needs, increasing the chance of closing deals effectively.

Creating a tactical attitude in sales and arrangement empowers you to build count on, get rid of arguments, and ultimately drive company growth by increasing your customer base and fostering lasting connections.

Verdict

In conclusion, as an insurance coverage representative, grasping interaction, analytic, and sales skills is essential to your success.

Bear in mind, 'technique makes best' - continue sharpening these vital abilities to master the affordable insurance policy market.

Stay encouraged, stay concentrated, and never stop learning.

All the best on your trip to becoming a successful insurance policy representative!

SPOILER ALERT!

Required Capabilities For Insurance Coverage Representatives To Attain Success

Author-Blaabjerg Gregersen

When browsing the huge landscape of the insurance policy sector, imagine yourself as a knowledgeable navigator with a compass in hand, charting a program towards success. As an insurance coverage representative, essential abilities are the assisting celebrities that will lead you with rough waters.

From the capability to communicate efficiently to grasping the art of settlement, the path to coming to be a successful insurance coverage representative is paved with crucial expertises. Yet what are these skills, and exactly how do they shape the trip ahead?

When connecting with clients and coworkers, you must properly communicate and demonstrate solid interpersonal abilities. Clear interaction is crucial in the insurance market to guarantee clients comprehend policies and make educated decisions.

Energetic listening is crucial to understanding customer demands and supplying customized solutions. Personal Excess Liability Insurance via empathy and understanding establishes trust fund, promoting lasting connections. Problem resolution abilities are crucial for dealing with difficult situations skillfully and preserving client contentment.

Collaborating with colleagues needs reliable interaction to enhance procedures and attain usual goals. Establishing solid social abilities not just boosts customer communications yet also fosters a positive work environment. Continuously refining these skills will certainly establish you apart as an effective insurance coverage representative in an affordable sector.

Establish your analytic and analytical capabilities to stand out as an insurance policy agent in a vibrant and hectic market. As https://foundever.com/blog/key-ways-insurance-companies-can-craft-a-personalized-customer-experience/ , you'll encounter numerous difficulties that need fast thinking and audio decision-making.

Right here are 4 key methods to boost your problem-solving and logical abilities:

1. ** Essential Believing **: Examine circumstances fairly and make informed choices.

2. ** Interest to Information **: Notification small discrepancies that might influence insurance coverage or cases.

3. ** Versatility **: Be adaptable in your strategy to taking care of various insurance scenarios.

4. ** Data Analysis **: Utilize information to recognize trends, analyze threats, and tailor insurance options to customers' demands.

To stand out as an insurance coverage agent, mastering sales and arrangement effectiveness is crucial for properly safeguarding customers and securing favorable insurance bargains. Being experienced at sales allows you to communicate the value of insurance products persuasively, attending to clients' requirements with tailored options.

Solid settlement abilities allow you to navigate pricing conversations, terms, and conditions to reach agreements that benefit both celebrations. By recognizing clients' problems and arguments, you can tailor your strategy to address their certain requirements, raising the likelihood of closing bargains successfully.

Creating a critical frame of mind in sales and settlement encourages you to construct depend on, get over arguments, and inevitably drive company growth by broadening your client base and promoting long-lasting partnerships.

Final thought

To conclude, as an insurance coverage representative, mastering interaction, analytic, and sales skills is critical to your success.

Bear in mind, 'practice makes ideal' - continue refining these crucial abilities to master the affordable insurance policy industry.

Keep inspired, remain concentrated, and never stop learning.

Best of luck on your trip to becoming a successful insurance agent!

When browsing the huge landscape of the insurance policy sector, imagine yourself as a knowledgeable navigator with a compass in hand, charting a program towards success. As an insurance coverage representative, essential abilities are the assisting celebrities that will lead you with rough waters.

From the capability to communicate efficiently to grasping the art of settlement, the path to coming to be a successful insurance coverage representative is paved with crucial expertises. Yet what are these skills, and exactly how do they shape the trip ahead?

Interaction and Interpersonal Skills

When connecting with clients and coworkers, you must properly communicate and demonstrate solid interpersonal abilities. Clear interaction is crucial in the insurance market to guarantee clients comprehend policies and make educated decisions.

Energetic listening is crucial to understanding customer demands and supplying customized solutions. Personal Excess Liability Insurance via empathy and understanding establishes trust fund, promoting lasting connections. Problem resolution abilities are crucial for dealing with difficult situations skillfully and preserving client contentment.

Collaborating with colleagues needs reliable interaction to enhance procedures and attain usual goals. Establishing solid social abilities not just boosts customer communications yet also fosters a positive work environment. Continuously refining these skills will certainly establish you apart as an effective insurance coverage representative in an affordable sector.

Problem-Solving and Analytical Talents

Establish your analytic and analytical capabilities to stand out as an insurance policy agent in a vibrant and hectic market. As https://foundever.com/blog/key-ways-insurance-companies-can-craft-a-personalized-customer-experience/ , you'll encounter numerous difficulties that need fast thinking and audio decision-making.

Right here are 4 key methods to boost your problem-solving and logical abilities:

1. ** Essential Believing **: Examine circumstances fairly and make informed choices.

2. ** Interest to Information **: Notification small discrepancies that might influence insurance coverage or cases.

3. ** Versatility **: Be adaptable in your strategy to taking care of various insurance scenarios.

4. ** Data Analysis **: Utilize information to recognize trends, analyze threats, and tailor insurance options to customers' demands.

Sales and Arrangement Efficiency

To stand out as an insurance coverage agent, mastering sales and arrangement effectiveness is crucial for properly safeguarding customers and securing favorable insurance bargains. Being experienced at sales allows you to communicate the value of insurance products persuasively, attending to clients' requirements with tailored options.